Here are a few key excerpts from the article by topic:

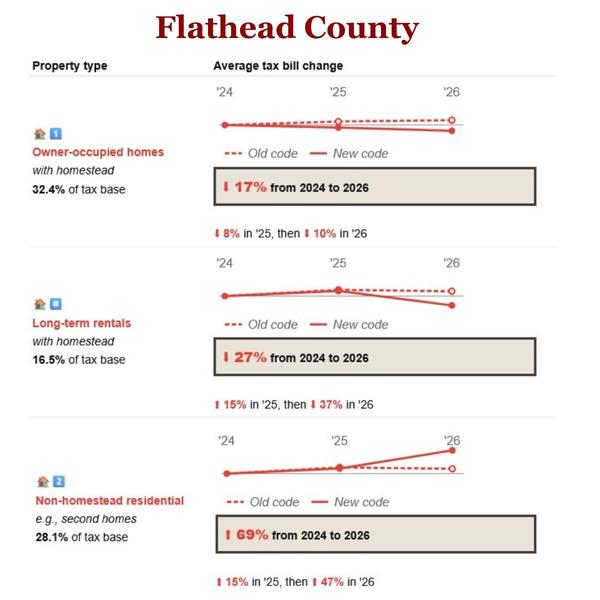

For second-home owners: "It will also bring massive tax increases — in excess of 60% — to many residential properties that don’t qualify for a new

“homestead” exemption aimed at reducing the tax burden on primary residences."

For a primary residence owner forecast: "on average, the proposal will reduce taxes for owner-occupied homes by 18% over two years, with most of those savings appearing on the 2025 tax bills mailed this fall."

Impact varies by County: "...the property-specific effects of the new tax law will depend on the many factors that figure into the state’s complex property tax math including the composition of city, county and school district tax bases, as well as how the revenue department values a given property relative to its

neighbors."

The more valuable the home, the higher the tax rate: "Additionally, both the interim rates for 2025 and the permanent ones for 2026 incorporate tiered structures that will focus a greater share of taxes on comparatively high-value properties. This year, for example, home values greater than $1.5 million will be

taxed at nearly three times the rate of values below $400,000."